The opening presentation addressed the enormous potential that Africa holds due to its rapidly growing youth population as well as its increasing move towards more stable and democratic models of governance. In this session, Dr. Mills presented what he defines as the six drivers and key questions for meaningful change on the continent.

There is a very different demographic future ahead for Africa over the next generation. Africa is going to double its population between now and 2045 and double its population to over 4 billion by the turn of the century. What this means in an urban context is that about 80% of this increase is forecasted to happen in African cities. For example, it is expected that there will be double the amount of people in African cities compared to Latin America.

There are and there will be more significant political changes taking place on the continent. Roughly ten African countries are considered to be free. This is a big difference compared to the 1980’s when we only had two. In addition to this, it is important to mention that the propensity of governments suffering coups has declined, reflecting greater management and control in particular by the African Union. Two thirds of Africans prefer democracy to any other system of government. The political system plays a very important role, as it determines how open the economy will be, how corruption will be addressed and how strong and independent the judicial systems are.

According to the Economist, the continent’s growth has changed over the past 20 years from being a ‘hopeless continent’ to ‘Africa rising’. Africa is a commodity rich continent, but also a commodity vulnerable continent. Most African countries are net-food importers which raises the domestic cost substantially. When there is a rise in commodity prices, the GDP goes up.

There are plenty of business opportunities on the continent which include:

Population Growth: The continent’s biggest opportunities are in its population growth as well as the change in demographics. In comparison with other areas of the world, the highest growth rates are in Africa. The continent is younger than Europe and Asia. People aged over 65 worldwide are projected to more than double by 2050.

Agribusiness remains a significant opportunity for investors. Africa has failed to take advantage of agriculture opportunities. There is still a big issue and challenge in yields which reflects in the absence of land and tenure. The demand for commodities remains high and cheap labor continues to be the trend. Climate changes remain a challenge for the African regions and for the agriculture business. Governments should ask “What kind of policies do we need to take up for developing the agribusiness opportunity”?

Economies of scale: The ratio of dependence is coming down markedly over the next couple of decades. In addition to this, a large number of people will come into the formal system over the next two generations which indicates that the money from government that was used to support informality will be now used for other development tasks. Formalisation, implies also the creation of economies of scale and a possible increase in urbanization rates.

Housing Sector: Africa is behind in terms of housing. Governments need to plan to create affordable housing projects for the population and for this they will need the private sector.

Basic needs: 70% of Africans don’t have access to energy and the same is true for potable water. There are many business opportunities related to the provision of these basic needs that will at the same time enable a significant transformation in the lives of many Africans.

Logistics: There is a lot to be done to improve logistics, the inefficiency of logistics and bureaucracy is very expensive for African economies.

Tourism: Despite its tourism potential, Africa makes itself very inaccessible to the international community. There where 62 million tourists coming to Africa in 2016 with an estimate increment of 8% in 2017 according to the available data and most recent study of the United Nations World Tourism Organization. This percentage is a very small portion compared to the global market, for example Europe had 671 million tourists in 2017.

Africa’s strengths include: the same time zone as Europe and the Middle East, an improving democracy, same languages as big business countries, business opportunities in agribusiness, housing, logistics and tourism.

Africa’s challenges include: lack of value addition, weak electricity, weak infrastructure, and poverty, elite driven political economy and weak institutions.

Speaker: Greg Mills, Dr. Director, Brenthurst Foundation

The opening session tackled the social, economic and political challenges and rewards of opening the continent up for business. In this panel, recognised industry and policy leaders shared their thoughts on free trade, synergies between the UAE and Africa, infrastructure, the private sector, taxes and some of the current challenges and investment opportunities for overseas companies interested in the continent.

Free trade will have a big impact in the very near future for the continent. Governments need to keep asking if they want to access the 97% of the economy outside Africa or if they want to create a stronger relationship with their neighbors. The question is whether African countries will prefer to integrate with relatively poor markets next door or if they will choose to do this with the external markets that are richer. There is no a correct answer. For example, what Asia learned very quickly was that developing a domestic market was part of the solution but that actually the opportunities lay outside. Some people consider that today the big creator of opportunities for Africa lies outside the region.

We cannot talk about free trade on the continent without referring to the African Continental Free Trade Agreement (ACFTA) which aims to drive intra-African trade and create a single market for the free movement of business, persons and investments. The ACFTA is a long term trajectory deal aimed to transform the continent into an international player in terms of commerce.

Despite efforts to promote trade within the continent, the participation of Africa in the global trade dynamics is very minimal. African countries will keep asking how to better integrate with other states. For an answer, we need to focus on fixing specific aspects of free trade. For example, South Africa spent a long time negotiating taxes instead of fixing the border post with Mozambique, Dar es-Salam, or Mombasa. The challenge is to enhance competitiveness in each country and at the same time be part of collective progress for the continent.

We need to differentiate between African economies. Generally the data studying Africa is an aggregation of 54 countries that are very different between them. The focus needs to be less on the African picture and more on the performing countries that can inspire the rest of the continent. Investors get an overload of information and people tend to generalise and maintain stereotypes, most of which can be negative. Every country should be read individually.

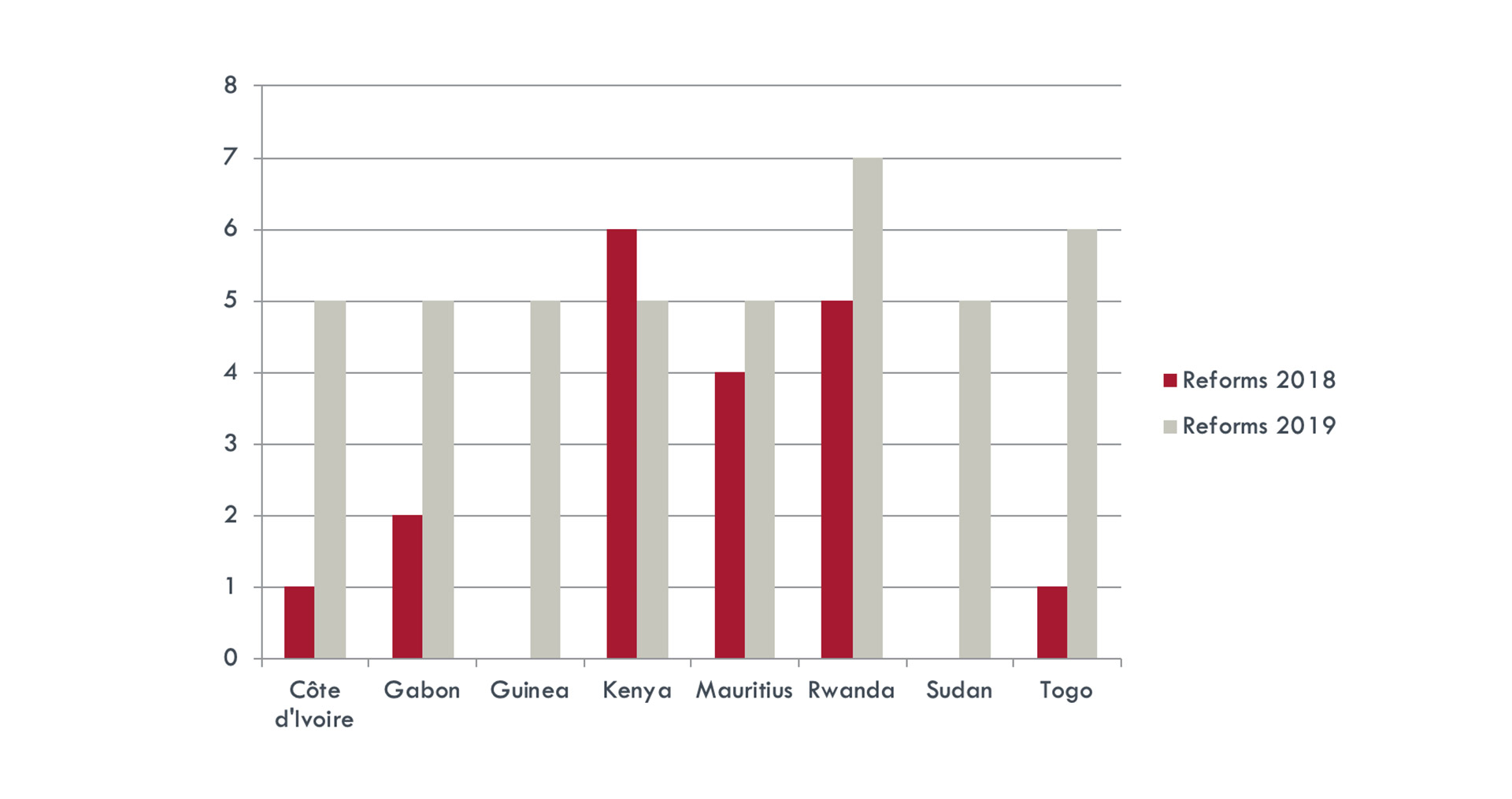

In addition to trade agreements between African countries, we are seeing a tremendous amount of reforms that will hopefully lead to growth acceleration in Africa. The Sub Saharan Region for example has a record in reforms for doing business with 107 reforms in 2019 as shown in the image below.

SubSaharan Africa Ease of Doing Business – Countries with more than 5 reforms

The Dubai Chamber of Commerce has been working with African countries since 2010 to facilitate and enhance trade and commerce on the continent. The UAE in terms of FDI has invested around USD11 billion into Africa. One of the objectives of the Chamber is to identify different drivers and specific investment sectors that can attract investors from the UAE to invest in Africa. Dubai can also play a pivotal role and help accelerate investment opportunities in Africa by mediating between African countries. For example, Dubai played and essential role in the relation between Ethiopia and Eritrea.

Africa has a lot to learn from the UAE, a country in which its people learned how to survive and create a leading tourist economy from a desert. When the UAE started, they had an intention, a spirit of unity but it was challenging to unify, as each country had its own resources and one way of seeing things. Finally, in 2008 they came together as one. Governments could apply the same rationale to Africa, it is possible to work together.

As a point to highlight, one of the biggest areas in which the UAE and African countries need to work jointly is the area of microfinance to people that cannot afford a high income, as a way to allow for self-sufficiency.

We cannot talk about development and growth without referring to infrastructure and the private sector. There are many projects and goals in infrastructure that could not be possible without the private sector. The main two reasons for this is that there is not enough public money and there is not enough financial aid that could cover what is needed to transform Africa.

For example Kenya Vision 2030 has tripled its projections for power generation, half of which has been generated by the private sector. The government would have never been able to do this on its own. This is one of the many examples in which the private sector has been involved and will keep being involved.

Africa has to move away from a state-led economic development vision. Many African states seem to be obsessed with the idea that government needs to be at the forefront of industry. There should be a separation between the public and the private sector and leaders must enhance private-sector led growth and investment within the continent. The concept of the nation state should be defined and governments need to stop seeing Public Private Partnerships as problematic.

The problem is that many countries make public private partnership arrangements under fiscal stress, trying to offload loss-making entities which they can no longer support and not because they are philosophical engaged with this instrument. There needs to be a change in the language for PPPs. They should be seen as what they are: an investment in public resource that will benefit the development of countries.

Johannesburg, for example, has a lot of challenges in infrastructure and the private sector is essential to stimulate demand and force the state to focus on these big issues. The conversation about aid and infrastructure needs to be focused on the economic development of the country. If you just leave the discussions for governments and policy makers, it is very hard to achieve sustainable cities. Much of the city’s infrastructure is in decay it has a clear 17-year infrastructure backlog.

One of the benefits of the private sector is that it protects its investments and so it reduces the incidences of corruption significantly. That said, it can create some anxiety in the political arena, although perhaps less in democratic systems.

In the UAE, the key for PPPs is to give participation to every player involved. It creates a bedrock of stability. You may sacrifice something in the short term, but it means growth of your vision over the long-term. You need to give incentives to investors.

Finally, it is also important to mention that African governments are still far from surviving only from private and public funds. They are still dependent on financial aid mainly because governments don’t have enough money to move from financial aid and because of the bad governance in some of the countries.

While Africa’s population is getting younger, some of Africa’s solutions are responding to problems of their parents. Leadership is not a question of age and the young leaders need to write the story focusing on tomorrow, on an industrialised world and on technology. They cannot just focus on addressing questions of colonialism.

Investment comes with knowledge transfer and this will benefit Africa’s young population.

Ethiopia for example, has a growth transformation plan for the first five years. They have focused very clearly on manufacturing and they have tax incentives to encourage certain industries such as the pharmaceutical sector. They also provide some of the cheapest energy in the world.

Another example in terms of taxes is South Africa, which has introduced economic zones with different tax incentives.

In general, clarity in taxes brings predictability and transparency in doing business. There is a need to emphasize and to mobilise our domestic entrepreneurs, and the banking industry is one of the leading sectors that can help with this mobilisation. Africa will not transform unless resources are mobilised and one of the biggest problem for investment in Africa is the difficulties in the mobilisation of savings. Strategies like mobile banking will be able to reduce the costs of banking.

In terms of urbanisation, one of the biggest challenges for governments when people are moving from rural areas to big cities will be to provide people with basic services such as access to water and housing, among others.

Currently peripheral areas of cities are not sustainable, as there are no roads, no electricity, no water. Therefore, there are a lot of opportunities for investment and for local communities to work for their development. Local communities should be able to organise themselves, to develop first locally and then use this business model and expand it. Cities still need a degree of regional organisation and understanding to be able also to develop locally.

Most of the African countries have a deficit in power; therefore, there is a big opportunity for investors in power transfer.

Following the opening presentation, the panelists insisted on the opportunity of tourism and pointed out that there is a big gap in terms of awareness, marketing and communications in this area.

China has arrived to the scene and has helped to convert the image of Africa from a place to be saved to a continent plenty of business opportunities. The impact of China has created a lot of development on the continent.

Technology advancements and population growth have significantly increased the business opportunities on the continent.

The African Continental Free Trade Agreement (ACFTA) will increase the opportunities for intra-African trade for the free movement of business, persons and investments.

Africa has a big challenge in microfinance to help people that cannot afford a high income, to be self-sufficient.

There is a challenge in the perception that Government has about PPPs, they need to stop seeing these instruments as problematic. Private sector is essential to stimulate demand and to support growth.

‘The Africa Legal Network is a powerful force for development, well-being and prosperity in the second largest continent.’

‘A happy, educated, healthy and safe population is a solid foundation for a successful long term investment and growth.’

‘Many countries of Africa are familiar with the effects of colonialism, corruption and conflict. The people in Africa deserve investment, tolerance, compassion and dialogue. The welfare of the people must always be considered. Investment requires vision, patience, persistence, men’s understanding and inspiration.’

African governments are becoming more ambitious with the development of energy projects. The main ...

The closing panel explored some of the issues that arise from the involvement of foreign players in ...

Private Equity players are considered as problem solvers driven by building regional businesses ...

For the last 15 years, African economies have continued to improve largely due to better governance ...